In today’s fast-paced world, sudden expenses such as urgent bills can take us by surprise. That’s why Credit24, a well-known non-bank lender, is becoming a beacon of hope for those needing a small loan.

We understand the importance of correctly considering such a decision, especially in difficult times. To help you make this choice, let’s compare Credit24’s services with other lenders, for example, if you need an urgent loan for 500 euros.

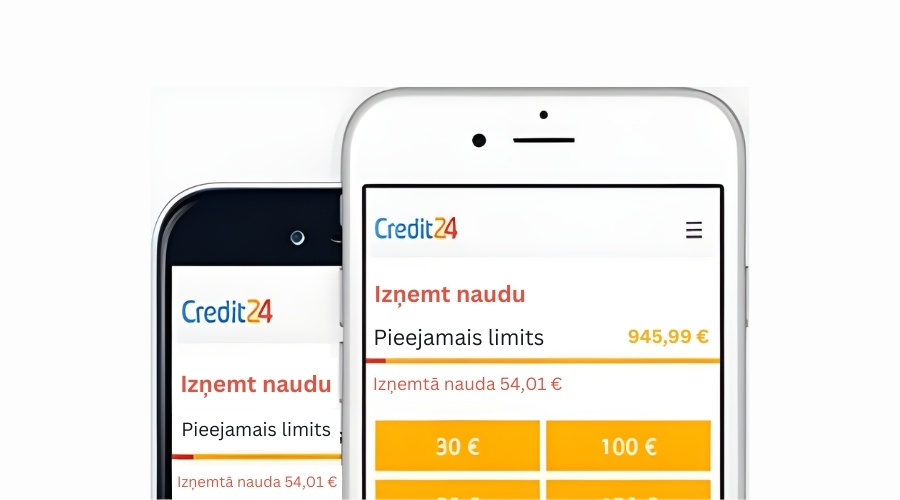

Flexible Credit24 for fast loans

When urgent bills are looming, and you need to find a financial solution quickly, Credit24 will be a beacon of hope for you. Known for its speed and flexible lending options, Credit24 is geared towards those urgently needing funds.

Why choose Credit24:

- Money in your account in as little as 10 minutes after your application is approved.

- Flexible credit line up to €7000 with interest only on the amount used.

- With Credit24, you only pay interest; there are no hidden fees.

Find out more about their services on the Credit24 website. With no hidden fees and a fast loan application process, it is the perfect option for those who need quick financial help.

Credit24 and other lenders

In the world of fast loans, it’s essential to understand how different lenders differ. Let’s compare Credit24 with other financial institutions, focusing on aspects such as speed of disbursement, interest rates, and loan terms.

- Vizia’s customer care

Vizia offers personal loans and lines of credit with annual percentage rates as low as 44.12%. Their strength is their 7-day customer service and fast online loan application process. - Avafin’s personalized approach

AvaFin provides personalized loan offers with interest rates starting at 7.99%. They focus on a transparent and secure lending process. However, quick access to funds from Credit24 is essential for urgent bill payments. - Established Luminor

Luminor Bank offers a range of loan products with interest rates starting at 9%. Being an established bank, it gives more confidence and has trusted customer service. However, a quick loan from Credit24 may be more beneficial for urgent financial assistance.

After analyzing these key factors, we give you a better idea of where Credit24 ranks in the list of lenders. However, it is up to you to choose between a fast, reliable, or customer-centric option.

Example from life – solving urgent problems

Alex urgently needs 500 euros to pay an unexpected medical bill. He is looking for a quick and easy way to get the money without long terms and high-interest rates.

After comparing different lenders, he chooses Credit24 because this company offers quick access to funds and transparent conditions. He fills out an online application, providing his personal data and financial information. His loan is approved in a few minutes.

Credit24 transfers 500 euros to Alex’s account 10 minutes after processing the loan. Alex pays his medical bill on time and avoids unnecessary stress and penalties. He also appreciates the flexibility in repaying the loan, which allows him to choose a convenient schedule.

Quick solutions for immediate needs

Alex’s experience with Credit24 demonstrates how a fast loan can be a lifeline in financial emergencies. Quick funds, easy application, and flexible repayment options make Credit24 a practical choice for those facing such difficulties.

Read also our other articles:

For anyone needing an urgent financial solution, exploring options such as consumer loans and credit can provide valuable guidance for making an informed decision.

Es, Beatrisa Granta, Topkredit.lv veidotāja, izmantoju savu finanšu pieredzi, lai palīdzētu lasītājiem orientēties kredītu izsniegšanas iespēju klāstā un izvairīties no biežāk pieļautajām kļūdām, ņemot patēriņa un ātros kredītus.