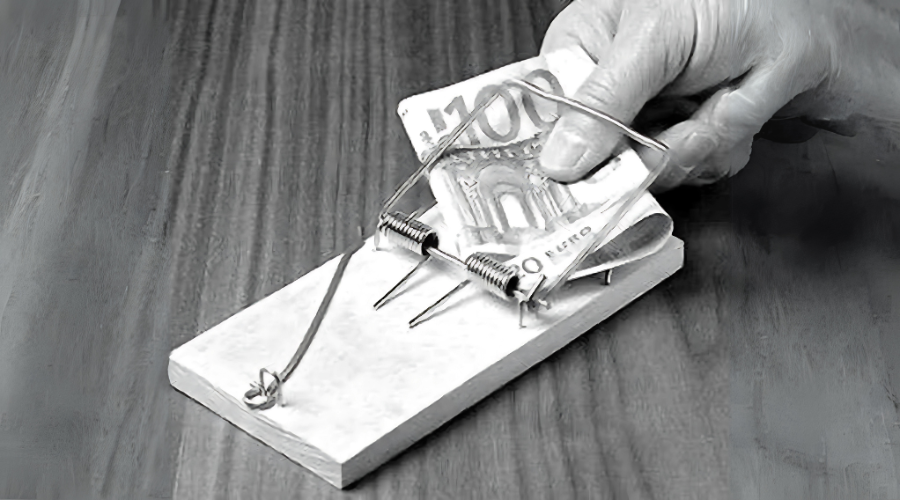

If you often face financial problems, finding a suitable loan may seem difficult. This is especially true for those who do not have the best credit history. Whether you have an unexpected expense or something to invest in, a small loan of €500 can help you.

In this article, we will look at the different options available for such a loan, focusing on people with a bad credit history. There are so-called black loans designed to enable people in debt to overcome their problems.

What is the difference between black loans and other loans?

Lenders and financial intermediaries are increasingly aware of the different situations that borrowers find themselves in. They are, therefore, developing products specifically designed for people with bad credit histories. However, these loans often have specific conditions.

For example, higher interest rates or shorter repayment periods are set to accommodate a higher risk from the lender’s point of view. However, even for debtors, such loans allow them to meet urgent financial needs and at the same time, improve their credit rating.

Where to look for loans with a bad credit history?

Getting a loan can be particularly difficult for people with a problematic financial past, such as those working abroad with irregular income or those whose accounts have been garnished by a bailiff. However, options like black loans, loans with bad credit history, and credit consolidation services can help you cope with financial difficulties.

Searching for a loan with a bad credit history can be like walking through a maze without a map. If you search independently, sending applications to dozens of lenders, you can get rejected almost everywhere. But we’ve found a way to make your search easier with the help of various financial brokers.

They can help you get credit for debtors

Financial brokers such as Sefinance, LK Centrs, or Altero are crucial in establishing reliable contact between borrowers with bad credit histories and potential lenders. Before we look at the possibilities offered by each of them, let’s find out how their help works.

These brokers have a broad understanding of the lending market and can negotiate terms on behalf of the borrower, often finding solutions that the debtor himself might not see. They also advise on loan consolidation, which can simplify the borrower’s financial obligations and reduce the overall cost of debt.

Sefinance – your partner in solving your financial problems

Sefinance is a financial intermediary that prides itself on fast application processing, easy cooperation, and accessibility for everyone, including those with a bad credit history. Sefinance offers personal loans from €500 to €25 000 at an annual interest rate of 6.9%, tailoring the options to the individual circumstances of its customers.

The application process is remotely efficient and allows fast money transfer to your account after signing the electronic contract. For those who need €500 but are worried about their bad credit history, Sefinance offers a suitable route, highlighting the importance of brokers in finding suitable loans for borrowers.

Credit solutions offered by the Latvijas Kredītu Centrs

With extensive experience in the lending sector, Latvijas Kredītu Centrs provides various lending services, including personal loans and loan consolidation. Interest rates are adjusted depending on your credit history and income.

They have minimum documentation requirements and transparent terms and conditions, making them ideal for those who want to navigate the loan application process quickly. The loan agreement process is particularly convenient for people in their younger years, allowing them to sign the agreement in the office. They also offer face-to-face advice on loans with a bad credit history.

Altero compares the loans offered to you

Another relatively new financial intermediary, Altero, also offers tailor-made solutions for you. When you approach them with your problem, they will be sure to find places to get money with a bad credit history. They work with 29 different lenders, which will cut your time considerably by sending one application to all areas simultaneously.

Although if a black loan is not your priority, you can get advice from them on the best loans for loan consolidation or car leasing. Altero also stands out when comparing CASCO or third-party liability insurance offers. Their service is entirely free so that you can find the best deal.

Lenders providing black loans

Sometimes, you do not want to go to a financial broker because of your prejudices or other reasons. You would love to find a place to get a loan instantly if you have a bad credit history. Netcredit.lv has directly compiled the lenders that can provide you with a black loan.

On the Netcredit website, you can select the “Loans for debtors” section to find all the information you need. You can see all the lender’s contact details, opening hours, and main loan conditions there. It also describes the details of borrowing from each lender, which is a sin not to know.

It is essential to repair your bad credit history

Although it is not very difficult to get a loan with a bad credit history, it is just as important to think about how to make your credit history better than it is. Repaying any new loan on time, no matter how small, will positively impact your credit rating.

To be able to choose the right loan for you with the best terms and various discounts, read the article “How to improve your credit rating?“. There, you will find practical tips on improving your situation, even if it is terrible.

Es, Beatrisa Granta, Topkredit.lv veidotāja, izmantoju savu finanšu pieredzi, lai palīdzētu lasītājiem orientēties kredītu izsniegšanas iespēju klāstā un izvairīties no biežāk pieļautajām kļūdām, ņemot patēriņa un ātros kredītus.